Why private banks must strengthen digital experience

Why should private banks strengthen their digital experience?

Introduction

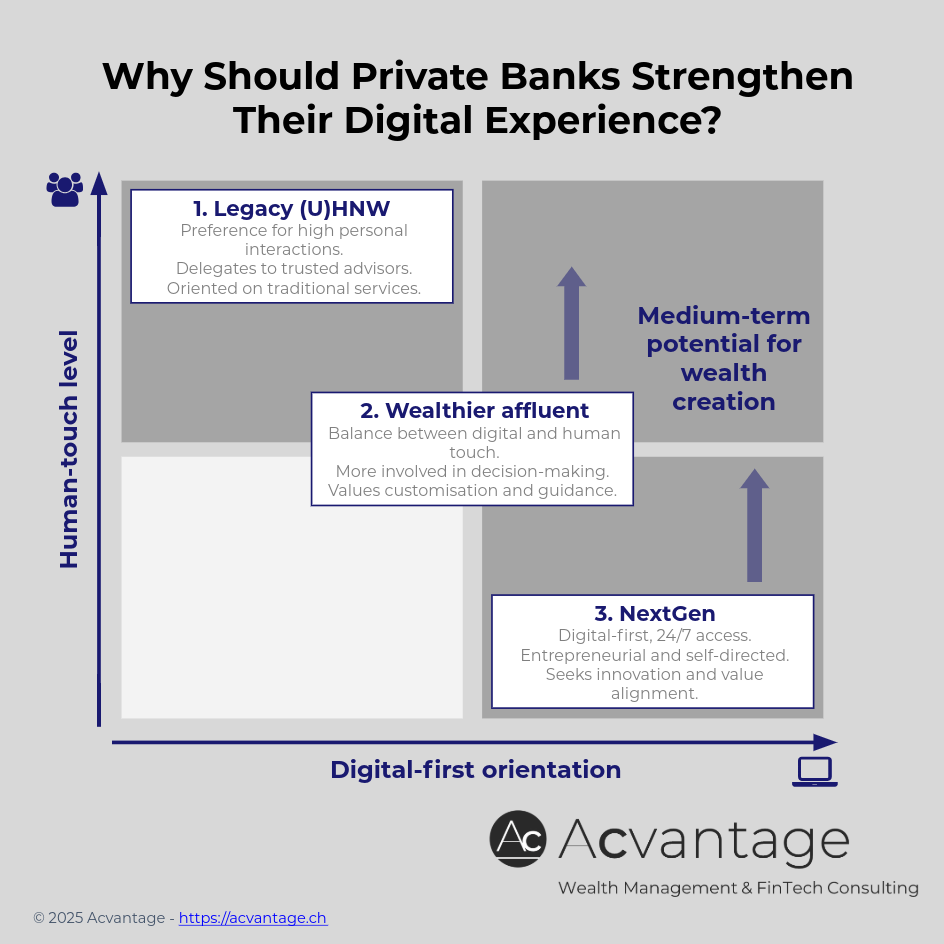

In wealth management, the client typology is changing rapidly, driven by the emergence of wealthier affluent segments combined with the rise of younger next-generation clients. Compared to the traditional upper HNW and UHNW groups still heavily targeted by private banks, these new client categories have different characteristics and sensitivities to digital versus human touch.

Typical client group differences

1. Key typical traits of legacy (U)HNW clients:

- Interactions: Used to highly personalised, human-touch service levels, with concierge-type features.

- Decision style: Delegators, who prefer to deal with a trusted RM or advisor and rely on dedicated banking experts.

- Services: Sophisticated and holistic financial services, traditional discretionary portfolio management, and wealth planning.

2. Key typical traits of wealthier affluent (and lower-end HNW) clients:

- Interactions: A balance between human touch and digital channels, more familiar with digital / mobile banking and tech tools than older client generations.

- Decision style: Actors, less RM-dependent than (U)HNW clients, willing to make their own decisions but appreciate expert guidance.

- Services: Less sophisticated investment solutions but with customisation potential, with needs related to business growth for business owners.

3. Key typical traits of NextGen clients:

- Interactions: Digital-first and on-the-go mindset, open to new interactive modes (mobile / metaverse), 24/7, and familiar with innovation.

- Decision style: Entrepreneurial (many are digitally savvy, self-made entrepreneurs).

- Services: Favour alignment with personal values and beliefs, needing advisory on investments, risk management, planning, and tax.

Strategic implications for private banks

Current business and operating models remain effective for serving legacy (U)HNW clients. However, the challenge lies with the emerging client groups, which have different expectations and preferences. A “one-size-fits-all” approach therefore poses a risk for incumbent institutions, especially considering the wealth creation potential of new segments in the medium term.

In this changing client paradigm, wealth management players have no choice but to progressively increase their digital emphasis, reengineering the client experience to more effectively address evolving customer needs, while also enabling segment-led solutions at scale.

So, how prepared is your private bank to thrive in an increasingly digital-first world?