Gap between digital disruption awareness and action in financial services

Introduction

The latest IMD’s Digital Vortex survey* offers critical insights into the financial industry’s awareness and response to digital disruption, suggesting a gap between readiness and tangible actions.

Key insights related to digital disruption from the survey

- Rapid industry transformation: The financial services sector is now the third most affected by digital disruption, underlining the urgent need for adaptive strategies.

- Digital disruption potential: While 91% of respondents anticipate major transformative changes due to digital technologies, there is a growing view of disruption as an opportunity rather than a threat.

- Evolving Executive perceptions: A striking 75% of Executives now express confidence in leveraging the benefits of digital disruption, a notable increase from previous years.

- Fintech boom: The rise of fintech unicorns post-COVID-19 pandemic underscores the burgeoning opportunities for innovation and market reshaping within the broader financial services sector.

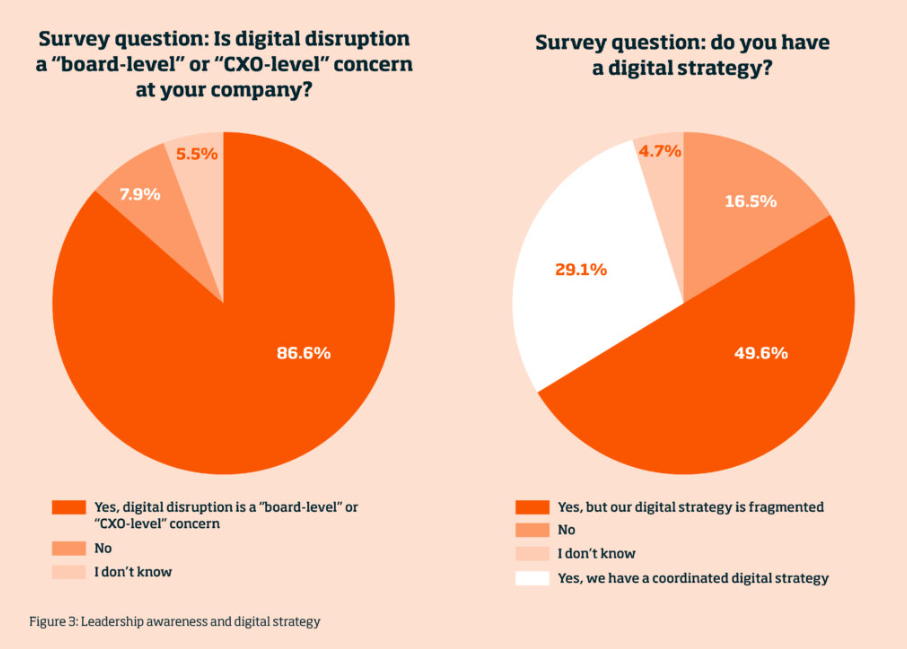

- Strategic digital adoption lag: Despite a high level of awareness about the importance of digital strategies, less than 30% of firms report having a well-coordinated digital strategy in place, highlighting a significant gap between recognition and execution as discussed below.

Dichotomy between awareness and action

Many organisations acknowledge digital disruption topics at the Board or CXO level, while struggling to translate this awareness into actionable and cohesive digital strategies.

A substantial portion of the industry indeed fails to respond adequately to new digital realities, risking obsolescence.

The prevalent “follower” approach among many firms, where innovation is imitated rather than originated, also inhibits competitive advantage.

Recommendations for Executives

1️. Embrace proactive digital leadership: Foster a culture of innovation and agility that encourages proactive responses to digital opportunities and challenges.

2️. Develop comprehensive digital strategies: Ensure a cohesive and integrated approach to digital transformation that aligns with the company’s overall strategic objectives.

3️. Invest in digital literacy and skills: Engage with external experts to complement and enhance the capabilities of internal teams, equipping them with essential digital skills and knowledge.

4️. Leverage data and analytics: Utilise data-driven insights to inform decision-making and identify new avenues for growth and customer engagement.

Conclusions

The IMD survey illustrates the critical need to eliminate the gap between awareness and action. By recognising the urgency of the situation and implementing tangible strategies, leaders in the financial sector can steer their organisations towards a future defined by resilience, adaptability, and sustained growth in an increasingly digital world.

Source of the chart: Riding the waves – Navigating the digital landscape in financial services, IMD, March 2024

[print-me target=”div” title=”Print”]