Fintechs & private banks: Convergence at play

Fintechs & private banks: Convergence at play – The Robinhood example

Introduction

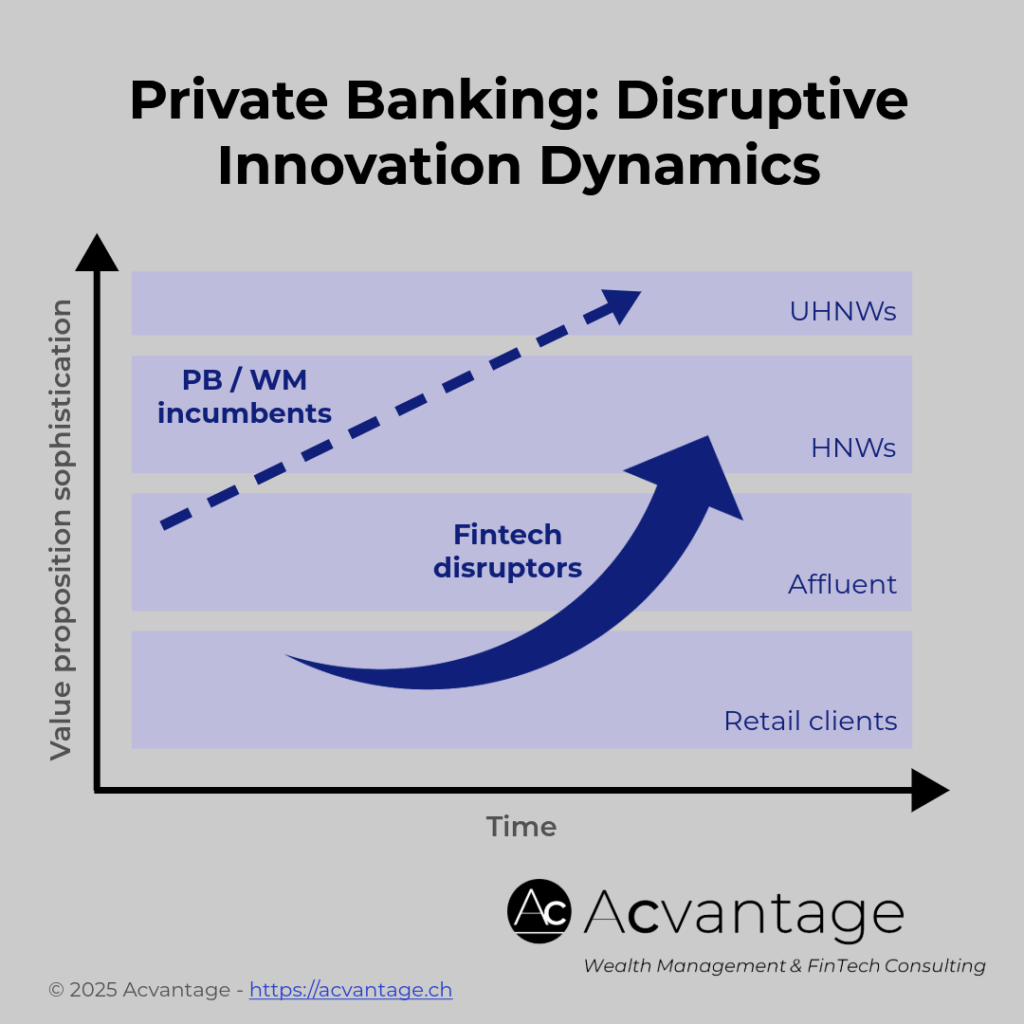

A new phase of convergence is emerging between fintech and traditional wealth management. As expectations rise across all segments, from retail to mass affluent, leading fintechs are progressively moving beyond transactional models to offer advisory, planning, and banking services that once defined private banking.

Robinhood’s strategy: Shift into private banking

In March 2025, Robinhood unveiled a comprehensive repositioning at its “Lost City of Gold” event – marking its evolution from a retail trading platform to a digitally native private banking and wealth partner. Its offering now extends beyond self-directed investing to full-service financial enablement.

Key elements of Robinhood’s development

1. Target clients: Affluent retail and mass affluent individuals (~3.2M Gold subscribers), previously underserved by incumbents.

2. Product stack: Robinhood Strategies (hybrid robo/human advisory), Cortex (AI-powered research assistant), and Robinhood Banking (digital-first accounts, perks, and payments).

3. Business model: Flat 0.25% advisory fee, capped at USD 250/year – significantly undercutting traditional AUM-based models.

4. Structural constraints: No banking license yet – services currently enabled through BaaS partnerships.

5. Expected next moves: Possible banking license application; deeper vertical integration via embedded finance and bundled user experiences.

Bottom-led disruption – A well-known phenomenon

As Harvard strategy expert Clayton Christensen explained, disruptive innovation rarely enters from the top. Challengers typically gain traction with overlooked or overcharged segments by offering “good enough” solutions that rapidly improve and scale upmarket.

Robinhood’s journey, from USD 50 traders to affluent households, is a textbook case. The firm started with cost-conscious traders, expanded into advisory, and now moves into higher-touch financial services for underserved affluent clients – without the legacy overheads of traditional private banks.

As trust, scale, and functionality grow, Robinhood could climb further upmarket, progressively challenging the status quo of established wealth managers and private banks serving HNW and UHNW clients.

Strategic implications for private banking leaders

Robinhood’s pivot reflects a broader trend of fintechs entering more mature, high-margin verticals – posing a systemic challenge to the traditional private banking model.

Leaders must weigh both the risks of margin erosion and client attrition, and the opportunity to reinvent legacy offerings. Relying on existing incumbent client bases is no longer viable in the face of an intergenerational wealth shift and rising digital expectations.

How will your firm future-proof its value proposition before the next wave of disruption scales?