Fintech funding trends in Q1/2024

Introduction

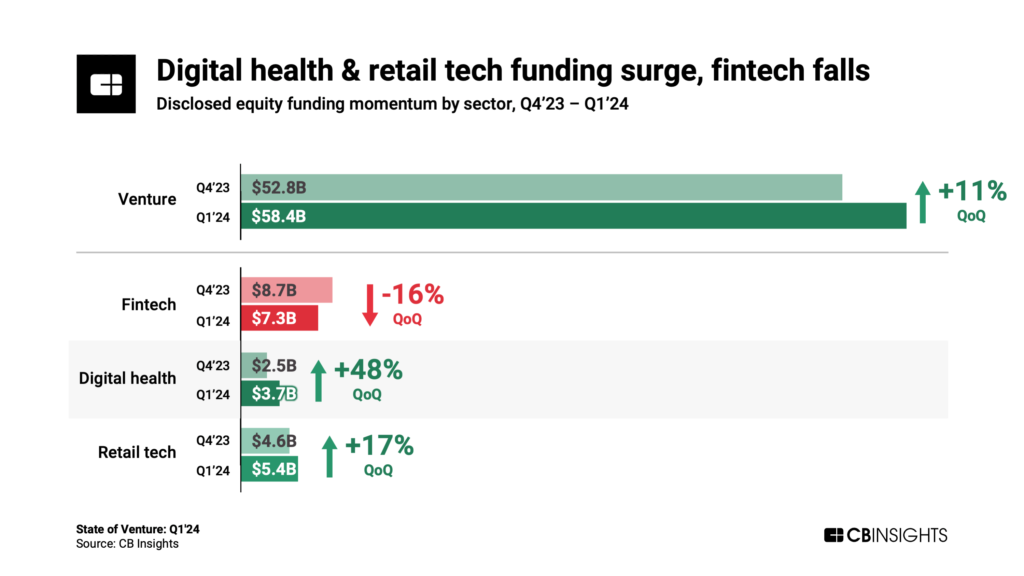

The latest CB Insights Q1 2024 state of venture report reveals significant shifts in the fintech sector’s funding landscape. CB Insights uses a combination of Machine Learning technology and expert analysts to systematically gather and analyse data from a wide range of public and proprietary sources. This dual method ensures comprehensive coverage of venture deals, funding amounts, and startup activity worldwide, providing a global reflection of industry trends that leaders in financial services can rely on for strategic planning.

Key insights related to fintech from the Q1/2024 report

- Global decline: Fintech funding decreased by 16% QoQ, totalling USD 7.3 bn, marking the lowest since early 2017.

- Deal dynamics: There was a 15% increase in equity deal-making, indicating sustained investor interest in specific fintech areas such as payments.

- Deal size: Despite an increased number of deals, their average size diminished.

- Volume of investments: There were 904 investments in fintech startups during the period.

- Sectoral focus: Companies developing broader AI solutions attracted larger funding rounds.

- Top deals: Monzo led with a USD 430 mio financing, the largest of the quarter.

- New unicorns: The sector saw the creation of 6 new unicorns.

- Geographical activity: US startups raised USD 3.3 bn across 393 deals, while European startups raised USD 2.2 bn across 203 transactions.

- YoY comparison: Funding has significantly dropped from USD 16 bn in Q1/2023 and USD 32.9 bn in Q1/2022.

Strategic implications

These insights suggest a cautious but targeted investment climate in fintech. The focus on smaller, numerous deals, particularly in innovative areas like AI and payments, highlights a strategic pivot towards technologies poised to redefine financial services in the longer run. The interest in AI solutions aligns with a broader digital transformation trend impacting multiple sectors at present.

The trends from Q1/2024 indicate a reshaping of the financial landscape, with a move towards smaller and more strategic investments, particularly in areas underpinned by technological innovation with strong disruptive potential. This shift suggests a growing emphasis on quality over quantity in fintech investments, showing that the sector is maturing with an increasing focus on value creation over hype. By aligning with these developments, financial and banking leaders can better position their organisations to capitalise on new collaborative opportunities and drive forward-thinking strategies in an increasingly competitive and tech-driven market.

Sources: CB Insights Q1 2024 state of venture report and TechCrunch, April 2024

[print-me target=”div” title=”Print”]