AI copilots in fundamental investment research

Introduction

AI copilots aren’t just efficiency tools, they are becoming cognitive extensions, empowering augmented fundamental analysts.

While much of the conversation still focuses on process automation or cost reduction, a much deeper shift is emerging: The use of AI to augment investment research workflows and uncover new alpha sources.

Strategic use cases

Hereafter are 3 practical use case examples where AI now supports financial analysts in primary research:

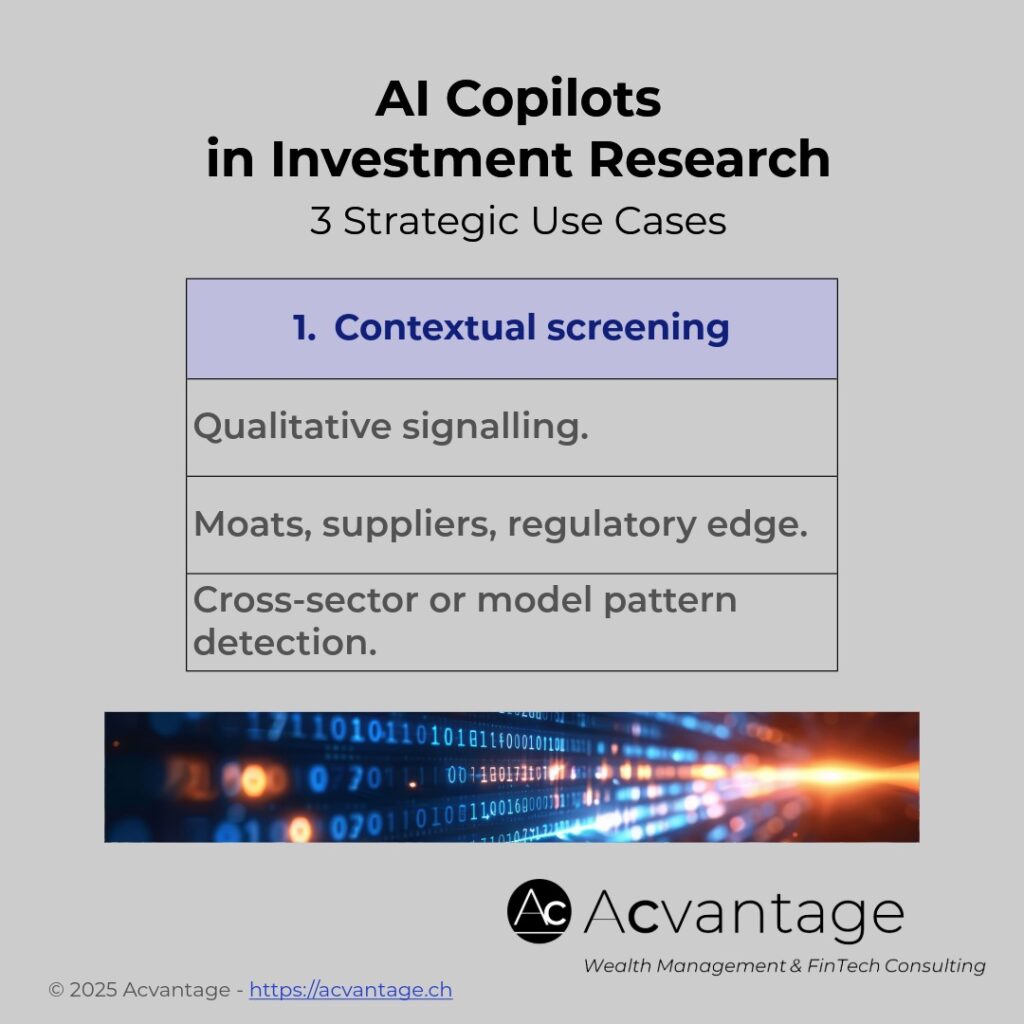

1. Contextual screening:

- Goes beyond metrics to uncover qualitative and strategic signals.

- Detects industry moats, regulatory tailwinds, or hidden supplier dependencies.

- Compares companies across business models, not just peer ratios.

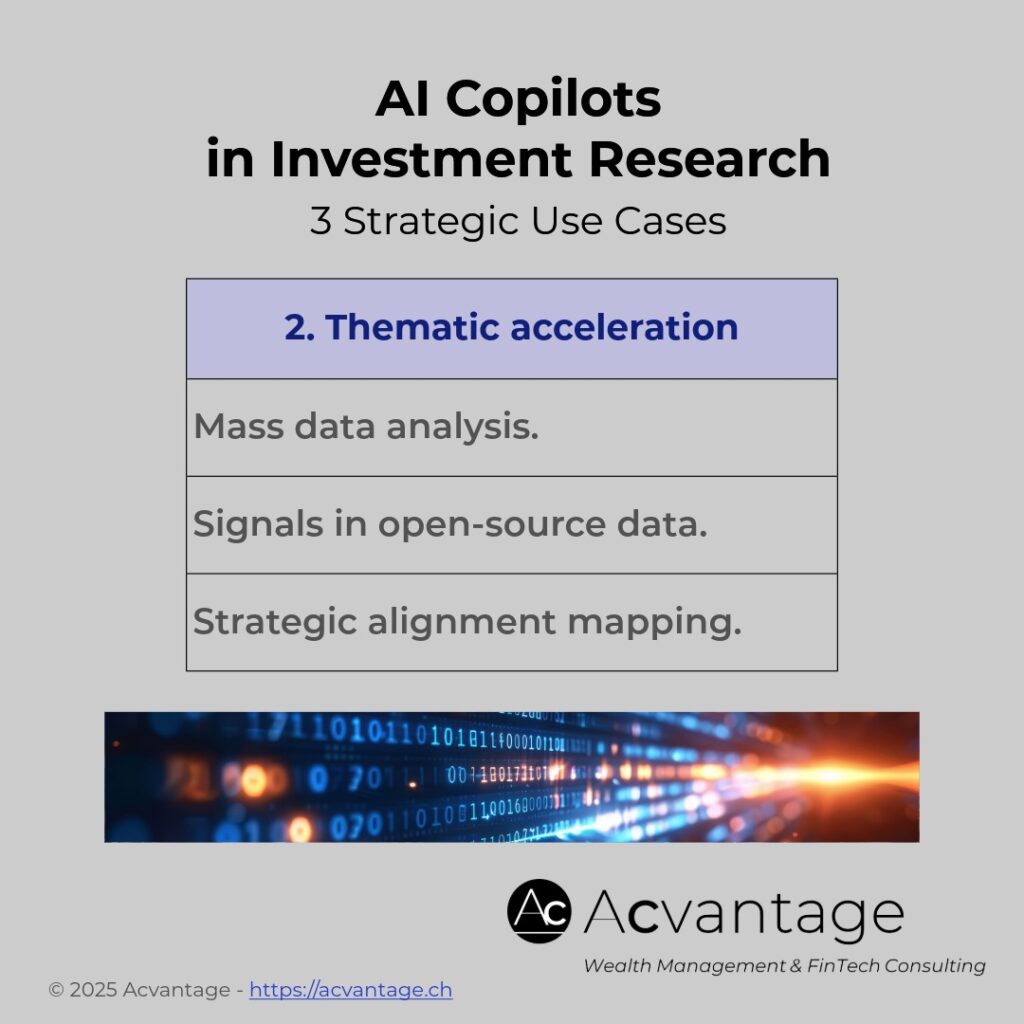

2. Thematic investing acceleration:

- Scans massive volumes of open-source data in real time.

- Detects early indicators aligned with key investment theses.

- E.g., early AI adoption, ESG taxonomy shifts, supply chain restructuring.

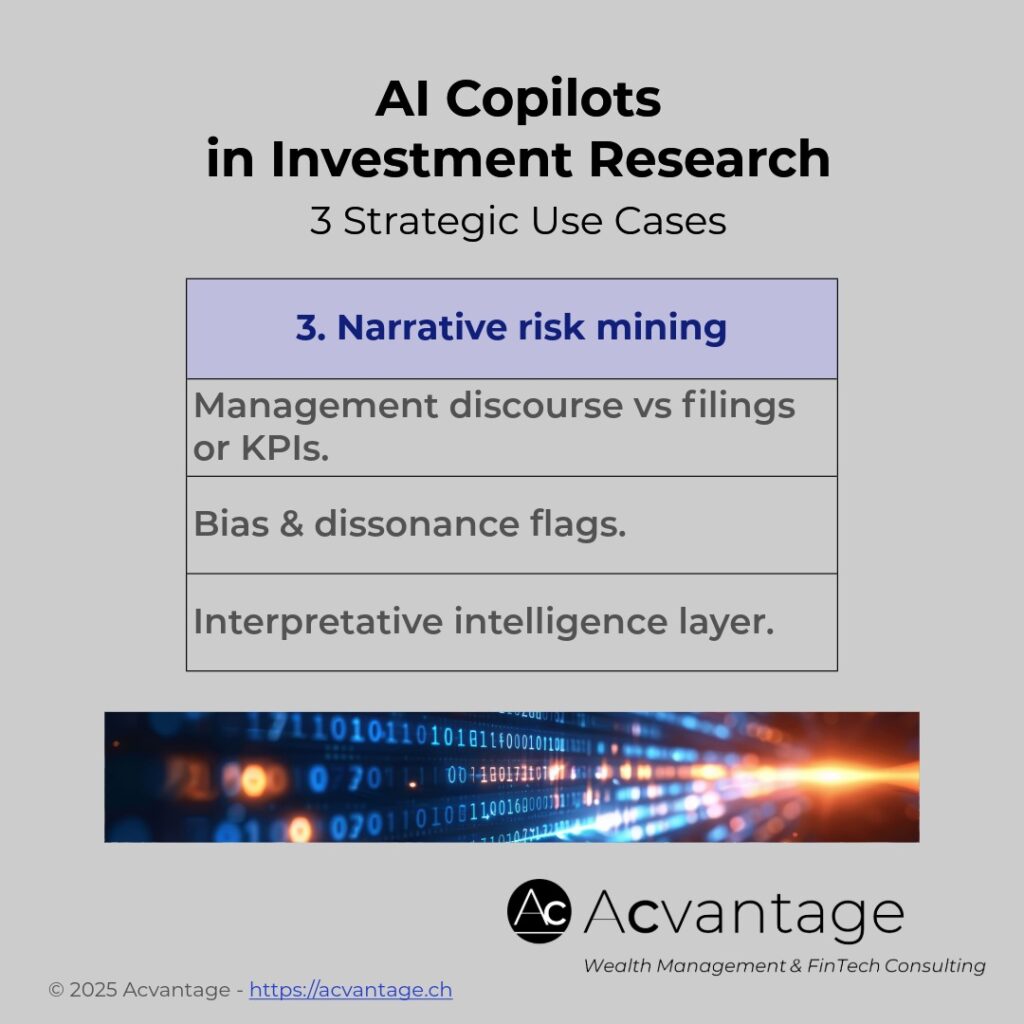

3. Narrative risk mining:

- Analyzes disconnects between top management tone (earnings calls) and facts (e.g., filings, KPIs).

- Flags misalignments, framing biases, or over-optimistic perspectives.

- Adds a layer of interpretive intelligence to standard analysis.

Conclusions

Such copilot tools do not replace human judgment, they extend it – by compressing the insight discovery cycle, enhancing research depth, and helping analysts surface hidden angles or risks and conviction signals more effectively.

Nonetheless, successful implementation requires more than just technical deployment. It demands clear oversight frameworks, robust governance, sound risk management, and a reaffirmation of the analyst’s central role in decision-making. Human expertise remains the cornerstone, only amplified by AI copilots.

Is your investment team already using AI copilots to augment its fundamental research process?