Bitcoin in corporate treasuries: Strategic signals

Bitcoin in corporate treasuries: Strategic signals for CFOs, CIOs, and asset managers

Introduction

Over the past 18 months, a growing number of corporations – beyond tech-native players – have begun integrating Bitcoin into their treasury strategies. Companies like Strategy (MSTR – Michael Saylor), Mara, and Tesla are reshaping the discourse around capital reserves, financial value creation, and digital asset integration.

This signals more than opportunistic allocation. It reflects a deeper convergence between digital assets, corporate finance, and systemic risk architecture – one that requires serious monitoring by both CFOs and institutional investors..

Why it matters

- Demand pressure for targeted digital assets like BTC may reduce liquid supply and amplify volatility.

- Liquidity-driven selloffs could propagate systemically.

- Correlations between BTC and equity prices may distort stock valuation.

- Corporate buyers could shift investor profiles and treasury governance baselines.

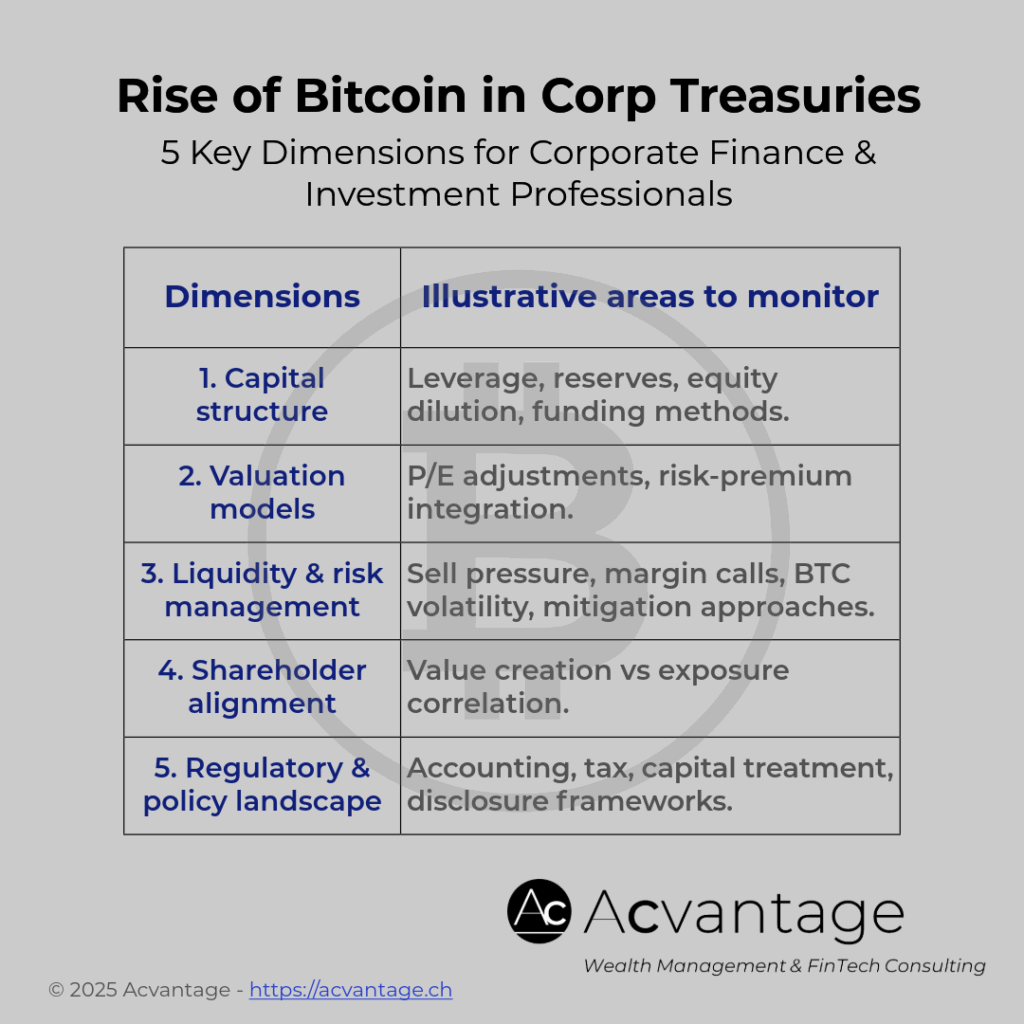

BTC treasury adoption introduces complex second-order effects

→ How should a listed company define and disclose BTC-related risk across its balance sheet?

→ How can shareholder value be created, beyond simple underlying BTC price appreciation?

→ Which safeguards prevent undue concentration, leverage, or accounting opacity?

These shifts may increasingly affect institutional allocators and traditional investment managers managing cross-asset portfolios.

Strategic takeaways for financial leaders

1. CFO perspective – risk and transparency:

- Active investments in BTC / digital asset require robust treasury governance, macro stress testing, adapted valuation models, and full-cycle risk frameworks (incl. guardrails on leverage, collateral, and contagion effects).

- Capital structure integrity and market trust must remain resilient, especially in downturns or highly volatile environments.

2. CIO perspective – asset selection and exposure:

Asset managers increasingly face a dual evaluation:

- How does BTC / digital asset exposure affect portfolio volatility, drawdown correlation, and return profiles?

- What mechanisms are in place to de-risk exposure when investing in BTC-heavy listed firms (e.g., via equity ETFs or direct holdings)?

Institutional BTC integration may act as a growth catalyst – but only if managed with discipline, foresight, and financial transparency.

As a CIO or investor, how are you adapting your stock selection and portfolio construction processes to reflect the rise of BTC treasury exposure?