BIS: Insights on DeFi & crypto risks and opportunities

Introduction

The Bank for International Settlements (BIS) has recently published a compelling report: “Cryptocurrencies and Decentralised Finance: Functions and Financial Stability Implications.” (BIS Working Paper No 156, April 2025).

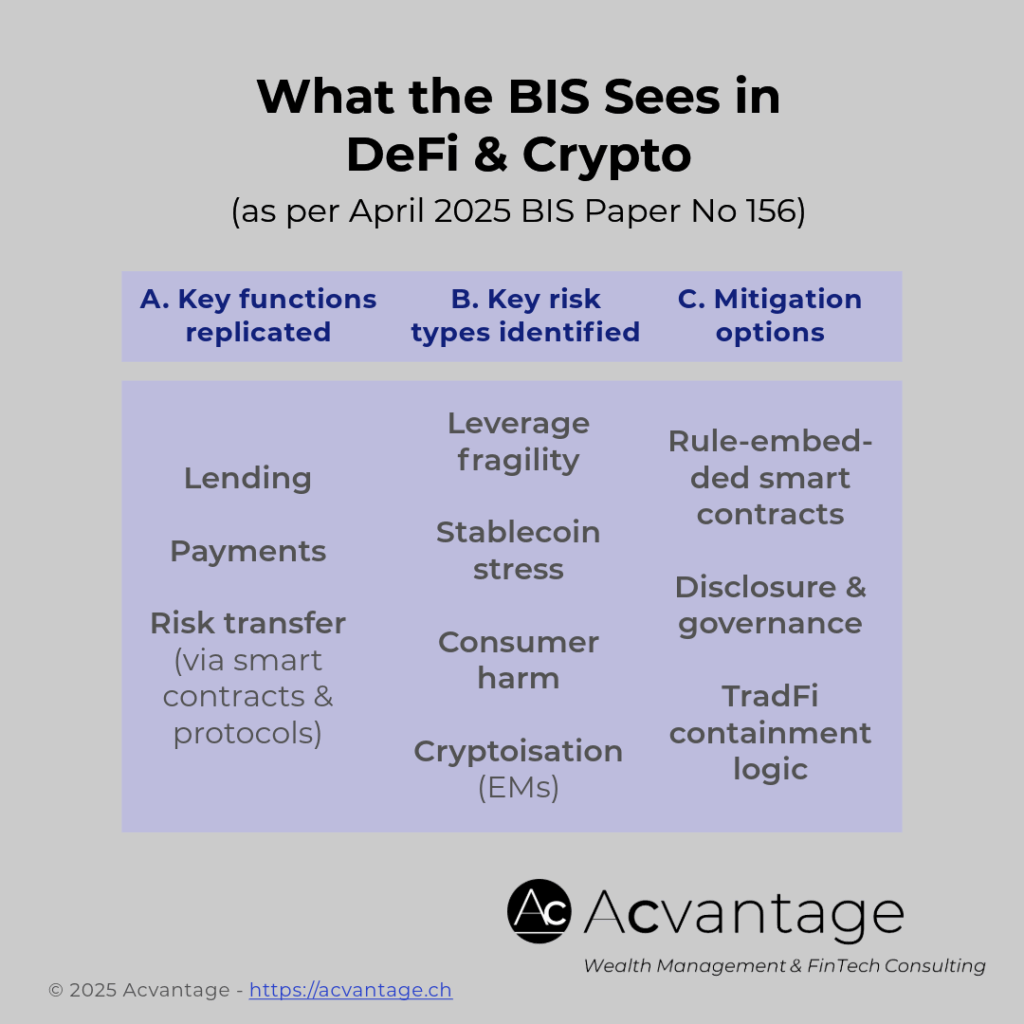

The analysis offers a sobering yet forward-looking perspective on how DeFi protocols replicate many of TradFi’s core economic functions, including payments, lending, and risk transfer, while introducing structural risks that transcend pure technology.

Key takeaways from the BIS paper

1. Scope of concepts covered:

- DeFi protocols and smart contracts.

- Stablecoins (fiat-, crypto-, and algorithmic-backed).

- Decentralized exchanges (DEXs) and lending platforms.

- Central Bank Digital Currencies (CBDCs – retail and wholesale).

- Derivatives, DAOs, yield farming, decentralized insurance.

2. Key risk categories identified:

- Information asymmetries in anonymous ecosystems.

- Systemic fragility via composability and leverage.

- Market failures (e.g., run risks on stablecoins).

- “Cryptoisation” risks in emerging markets.

- Consumer harm due to volatility and value extraction patterns.

3. Mitigation approaches explored:

- Embedding regulatory logic within smart contracts.

- Strengthened over-collateralization and transparency requirements.

- Improved disclosure and governance frameworks.

- Equivalence-based regulation for DeFi-TradFi convergence.

- “Containment” logic to limit potential TradFi spillovers.

Strategic implications for financial leaders

As digital asset infrastructure increasingly intersects with sovereign reserve policy, institutional adoption (ETFs, RWAs), and cross-border monetary systems (including CBDC initiatives), the case for structured, risk-sensitive, and innovation-respecting regulation becomes not just necessary – but strategically vital.

Beyond compliance, this shift requires leadership.

For financial professionals in banking, asset management, infrastructure, or fintech, this means:

- Tracking regulatory trajectories early to anticipate impacts on product innovation, infrastructure design, and capital strategy.

- Engaging with regulators where possible to shape smart, innovation-compatible frameworks.

- Evaluating internal readiness, from risk governance to data architecture, to operate in a programmable finance landscape.

- Exploring business model adaptability in response to the broader evolution of digital finance – including tokenization, programmable infrastructure, decentralized intermediation, and emerging regulatory architectures.

In a context of accelerating convergence, passivity is a risk. Strategic alignment starts with clarity and action.

Is your business model structurally ready for a world where digital finance increasingly converges with traditional verticals?