Moving beyond digitisation to digital private banking

Introduction

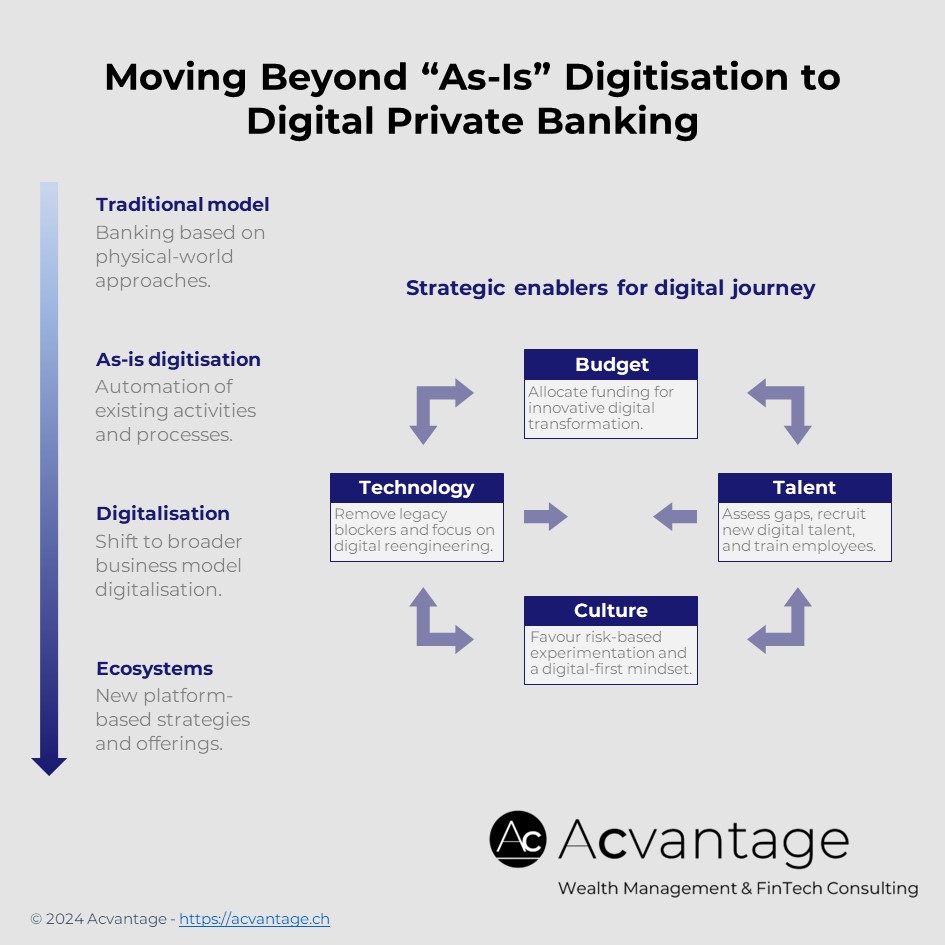

Nowadays, many private banks are still focusing on automating existing processes and digitising their services instead of considering a fully digital private banking approach. However, to truly thrive, wealth institutions need to embrace a more comprehensive digital banking mindset. Concretely, this means progressively shifting from “as-is” digitisation to full business model digitalisation.

Transitioning from the old world to the new one

In this perspective, the sequence towards a digital banking paradigm can schematically be phased as follows:

1. Traditional private banking (old in old ways): This initial phase involves heavy reliance on physical-world assets and customer interactions.

2. Digitised wealth activities (old in new ways): Wealth managers in this stage use digital channels to enhance service delivery and client reach, while also increasing internal productivity through automation of existing processes.

3. Digital private banking (new in new ways): Here, private banks leverage digital solutions and strategies such as data analytics, automated customer journeys, or AI-powered decision-making enhancement, turning data insights into revenues.

4. Ecosystems (innovative co-development): This final phase involves creating innovative services through strategic digital partnerships, establishing market platforms, offering services as a model, and delivering hyper-personalisation at scale.

Strategic barriers faced by Executives

Currently, most traditional private banks are navigating either within phase 2 or in early experimental stages of phase 3.

Indeed, Executives typically face the following strategic barriers:

- Budget constraints: Financial limitations restrict the ability to invest in new technologies.

- Legacy systems: Outdated technology infrastructures hinder seamless digital transformation.

- Limited internal digital talent: A shortage of skilled digital professionals slows progress.

- Risk aversion and culture: A conservative approach and limited experience in complex digital transformation impede innovation.

Mitigation strategies to accelerate evolution

Nonetheless, wealth management leaders can undertake a series of actions to remove these barriers and accelerate the path towards a digital private banking model:

1. Allocate strategic budgets: Prioritise funding for digital transformation projects with strong innovation potential.

2. Reengineer IT infrastructure: Remove unnecessary solutions and upgrade legacy systems to enable digital banking modelling.

3. Enhance digital skills: Recruit and train employees with the necessary digital expertise.

4. Foster a culture of innovation: Encourage experimentation and embrace a digital-first mindset.

Conclusions

By addressing these barriers, private banks can accelerate their transition from “as-is” digitisation to a more comprehensive business model digitalisation. This shift enhances efficiency, creates value, and speeds up digital progression, boosting competitiveness and enabling incumbents to build new leadership positions in the digital space.