Leadership evolution for bankers in the age of AI

Introduction*

An Unstoppable AI-Driven Labour Disruption

According to the OECD Employment Outlook 2023 report, 60% of finance and manufacturing employees in developed countries anticipate the potential loss of their jobs to AI within the next decade. This sentiment is not confined to lower-skilled roles. Indeed, high-skill professions (including those of CEOs, lawyers or engineers), traditionally considered more secure and stable, are now facing increasing vulnerability to AI disruption. Whilst the long-term effects of AI on the job market are challenging to quantify at this early stage, the technology’s impact on the global workforce will obviously be both significant and profound.

The Fourth Industrial Revolution

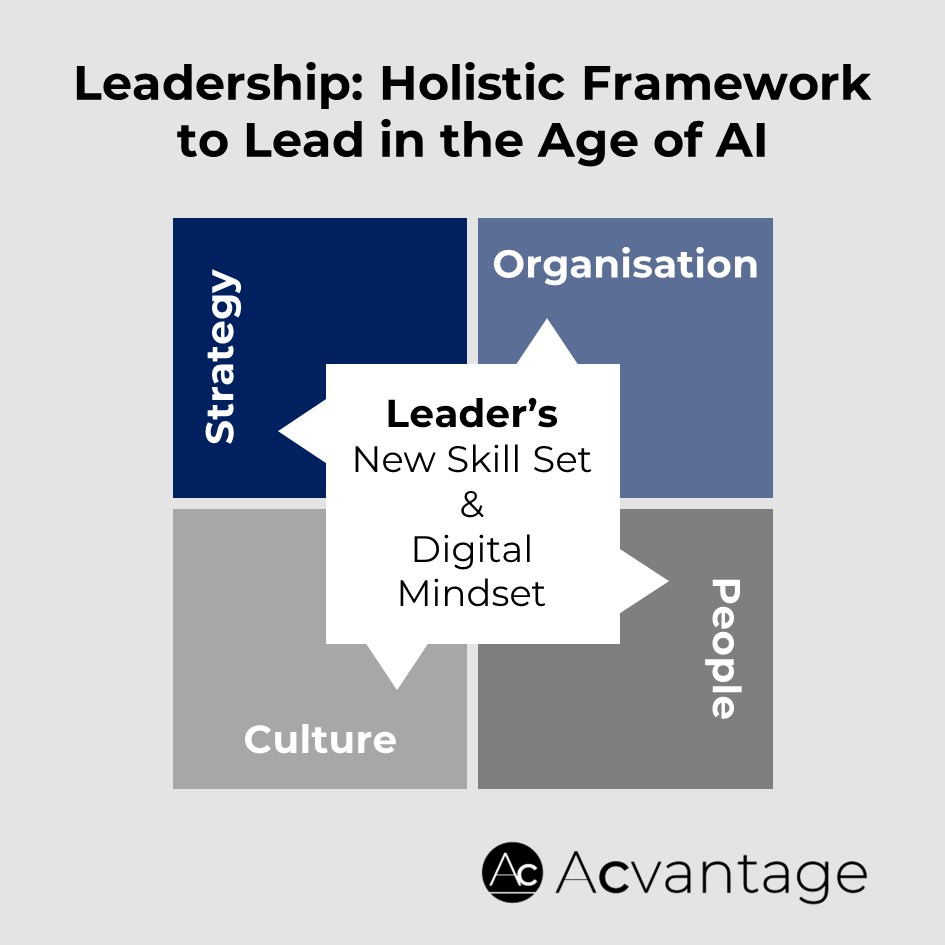

More broadly, AI, along with other new technologies such as robotics or blockchain, will be an accelerating catalyst for the so-called Fourth Industrial Revolution, blending digital, biological, and physical innovations and reshaping the labour landscape even further. The upcoming transformation of entire industries will require a new paradigm in leadership that will become a key success factor in adapting to these sweeping changes.

AI’s Impact on Banking

The impact of AI extends already beyond blue-collar roles, gradually affecting, in the banking sector, more and more white-collar and professional positions. In the financial industry, where leaders, line managers, and experts are accustomed to a certain level of stability and demand based on knowledge, the risks of disruption are now rapidly growing amidst the mainstream arrival of Gen AI solutions. This evolving dynamic necessitates an urgent need for both banking leaders as well as workers to adapt, reconsidering their roles and skill sets in the upcoming AI-driven world.

I. Digital vs Human Intelligence

AI’s Strengths: Data Work and Efficiency

AI excels in data analysis and processing, handling tasks with a level of precision and productivity that humans cannot attain. In banking, AI systems can, for example, analyse market trends or very large amounts of customer, financial, and portfolio data much more quickly and accurately than human analysts. They are also highly effective at managing repetitive tasks like transaction processing, where their efficiency reduces errors and increases overall speed and quality.

AI’s Limitations: The Human Touch

However, AI falls short in softer areas typically requiring creativity, critical thinking, or the nuances of human relationships. In banking, such skills are essential for activities related to building client trust or servicing customers, as well as in team interactions. As an illustration, while AI can mechanically process loan applications, it cannot replace the personal judgment and intuition applied by an experienced loan officer when dealing with individual circumstances, a changing context, or ambiguity.

The Best of Both Worlds: Combining AI with Human Intelligence

In consequence, moving beyond the common belief that AI only poses a replacement risk for jobs, it appears increasingly clear that the synergistic blending of AI and human intelligence offers a gigantic potential for companies. AI’s role in handling mundane and repetitive tasks frees human workers to focus on much higher-value activities, such as strategy execution. In banking, this complementary approach means AI can manage administrative tasks or deliver complex automated processes, while humans can focus on customer relations or innovative product development for example. In practice, the combination of AI with humans typically generates more value than the sum of the parts.

II. Paradigm Shift in Leadership Roles

Developing Digital Savviness and AI Understanding

In the banking sector, leaders need to further develop their digital savviness to understand how new technologies can be used operationally and strategically. Grasping AI’s capabilities, models, and limitations is crucial for identifying innovative use cases. For example, AI can enhance onboarding, KYC, and fraud detection activities in Risk and Compliance processes. Initially relying on external expertise, the goal is to cultivate these competencies internally, fostering an environment where technology and strategy are tightly intertwined.

AI Integration in Leadership

Incorporating AI into leadership involves more than just adopting new tools; it requires an evolution in managerial mindset. AI’s ability to process vast amounts of data can provide unparalleled strategic insights, allowing leaders to make more informed, data-driven decisions. For example, using AI for trend spotting or predictive analytics combined with human intuition and experience will augment banking executives’ effectiveness, reinforcing, in turn, strategic thinking, design, and execution.

Evolving from Hard to Softer Skills

As AI becomes increasingly adept at handling technical and logical tasks, banking leaders have to gradually increase their focus towards complementary skills with a stronger human touch, enhancing emotional intelligence, interpersonal skills, and understanding of the people dynamics in the organisation. For instance, an executive’s ability to empathise, motivate, and communicate effectively will become even more important to effectively lead the workforce into the AI disruption.

III. Recommendations for Banking Leaders

At the Strategy and Business Levels

Banking leaders should conduct a thorough analysis of AI’s potential, determining why, where, and how to implement the technology. This involves identifying innovative ways AI can enhance the banking value chain, like automating complex decision-making processes or creating personalised financial services at scale. Executives should focus on integrating AI to maximise value creation and minimise interferences, envisioning new AI-driven business models that can redefine the customer experience in banking. If strategically applied, a wise combination of AI-powered solutions and processes augmenting human talent can provide a significant sustainable competitive edge.

At the Organisational Level

In today’s rapidly evolving business landscape accelerated by technological breakthroughs, long-term strategies and top-down decision-making historically used by the banking chain of command are no longer suitable. Banking leaders must hence facilitate a progressive shift towards Agile and Lean Startup methodologies, enabling quicker adaptation to market changes. Agile transforms organisations from rigid and rather slow hierarchies into dynamic and empowered teams, promoting innovation and responsiveness. Lean Startup prioritises customer feedback and experimentation, enhancing banks’ client-centricity and better aligning services with changing customer needs.

At the People Level

a. HR Management Practices

Banking leaders have to manage a diverse workforce comprising baby boomers and younger generations. Adapting recruitment strategies to attract Gen Y and Z, for instance, by highlighting technology-driven roles and flexible working policies, is crucial. Aligning motivation and retention strategies involves offering mentorship programmes for younger employees or promotion opportunities for experienced staff. Implementing a continuous learning approach is also essential to ensure employees adapt to new technologies and stay ahead in a rapidly evolving sector.

b. New Skill Set Requirements for an Agile Firm

To be able to create an Agile firm, executives need to foster a work environment that values creativity, critical thinking, curiosity, and emotional intelligence, human traits that are all highly complementary to the strengths of AI. In practice, encouraging cross-departmental collaboration can ignite creativity, while promoting problem-solving workshops enhances critical thinking. Curiosity can be fostered through “innovation labs” where employees experiment with new banking technologies. Additionally, technical training in AI and data analytics is essential for managing AI-enhanced teams.

c. Leveraging New AI-Enabled Jobs

As AI advances, certain functions and activities will disappear while new roles will emerge. These include technology specialists for AI deployment and management, roles focused on maintaining AI system integrity and robustness, or governance positions for regulatory compliance, privacy, and ethics in AI. Banking leaders must stay up to date on such structural changes and ensure the right mix of competencies to sustain technology integration.

d. Developing Existing Employees

Upskilling and reskilling are vital for the workforce’s transition to an AI-driven banking environment. Executives must upskill existing employees to handle higher value-added responsibilities in similar functions, such as training branch staff in AI-assisted customer advisory roles. Reskilling is also crucial for redeploying employees originally involved in activities now replaced by AI, such as transitioning manual data analysts to roles overseeing AI data processing systems. Cumulatively, in instances where development options (at least in the short term) are limited, strategically hiring new talent with requisite digital skills is obviously also necessary.

e. Addressing the Talent Gap

The external tech-savvy talent pool is already insufficient to meet the overshooting global demand driven by AI advancements. Hence, the focus should be on developing and retaining existing employees whenever possible. Offering upskilling, reskilling or career development in emerging AI roles and aligning corporate culture with digital-first values can help bridge this gap. Banks must recognise that recruiting external talent alone will not suffice to meet their AI-driven needs in the medium term and should prioritise internal talent development and retention to maintain a competitive edge.

At the Cultural Level

As banking leaders adopt Agile and Lean Startup methodologies, they must also drive a deeper and longer-term cultural transformation. This shift goes beyond practical implementations, necessitating a progressive realignment of core values and behaviours. Instilling such a new culture takes time and requires ongoing commitment and reinforcement from leadership to consistently foster and embody values that encourage people empowerment, collaboration, innovation, autonomy, and client-centric decision-making. As these values gradually permeate the firm, they align with evolving market dynamics and technological disruptions such as that of AI, ensuring a much stronger bank’s resilience and adaptability in the long run.

Conclusion and Call to Action

The Significance of Human Leadership

In 2023, Goldman Sachs predicted AI would impact up to 300 million jobs in the next years. Banking leaders will have to drive their business through these challenging times. Instead of seeing it as a threat, they should embrace it as an opportunity for transformative change, involving not only preparing their firms for the AI tsunami but also harnessing technology for innovation and future growth. Indeed, the journey ahead offers immense potential for those who adopt a strategic and holistic approach to managing AI disruption.

The Risk of Not Acting

Leaders who hesitate or delay integrating AI risk placing their firms at a sustainable competitive disadvantage. The journey through AI transformation in banking will nonetheless be complex and uncertain, demanding courage, determination, and confidence, quintessential traits of leadership.

CTA: Start Your AI Leadership Journey Now

To be able to effectively guide their firms and employees towards success in the age of AI, executives need to deepen their understanding of new technologies, implement an agile and transformative leadership, and enhance their skill set by actively adopting development measures such as formal training, coaching, and mentoring.

So, to what extent does your strategic thinking incorporate AI considerations today?

* This long-form article, titled “Leadership Evolution for Bankers in the Age of AI”, was published in January 2024 in the 63rd monthly edition of the respected and widely distributed digital magazine Corporate Investment Times.

[print-me target=”div” title=”Print”]