Private banking: Digital adoption in Switzerland and Liechtenstein

Introduction

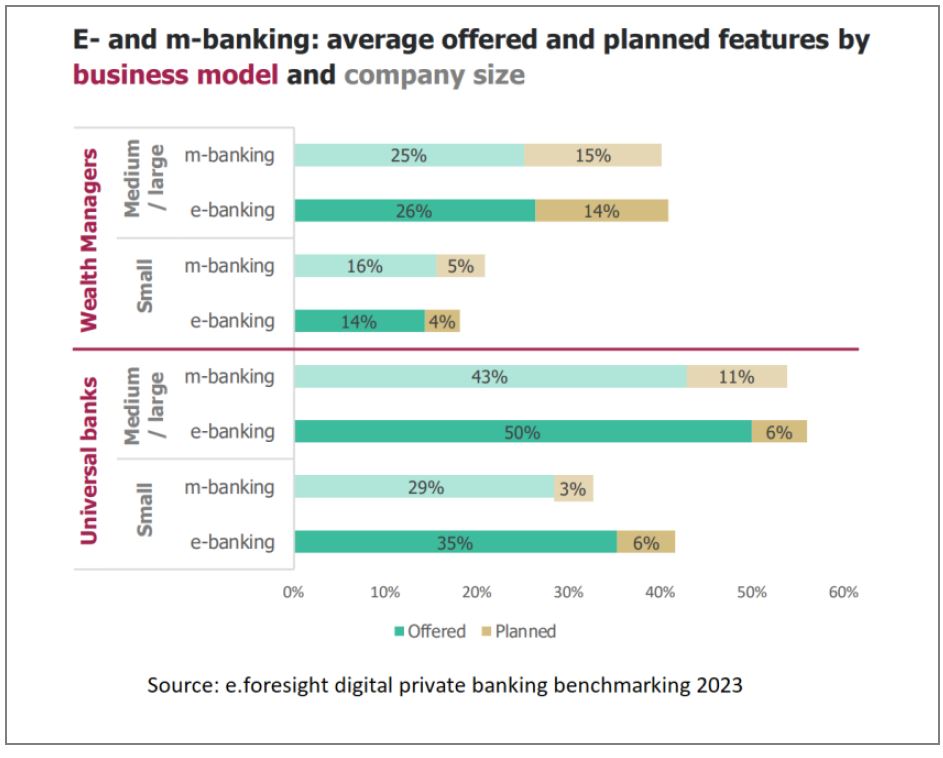

A digital private banking benchmarking study, published in December 2023 by e.foresight in collaboration with ISFB and HEG, provides market insights into the digital adoption of e-banking, mobile banking, and front-oriented tech solutions across the wealth management industry in Switzerland and Liechtenstein.

Key insights on digital adoption from the report

- The current average functionality coverage across all client interaction channels is just 32%.

- Digital interfaces primarily emphasise administrative services, with less focus on advanced or business-oriented use cases.

- Medium-/large-sized and universal banks lead in adopting digital functionalities.

- Indeed, medium and large players, currently with an average functionality coverage of 25%, plan to increase it to approximately 40% soon.

- Smaller players tend to have a lower adoption rate and show less appetite for implementing new technological features in the short term.

- The most digitally advanced institutions are transitioning to a hybrid model and developing omnichannel strategies.

- Other financial players tend to prefer a “physical-first” model while selectively investing in specific functionalities to enhance the CX.

Recommendations from Acvantage for wealth management Executives

1. Adopt a holistic digital strategy design perspective: Embrace a comprehensive approach to digital transformation rather than a siloed or fragmented standpoint.

2. Focus on client and business dimensions initially: Start by identifying specific business needs, opportunities or challenges before leveraging technology to address these points.

3. Consider technology as a tool, rather than an end: Resist the hype and remember that digital should serve as a strategic enabler.

4. Address organisational and people dimensions: Recognise the need for developing digital competencies and fostering a cultural shift towards innovation and experimentation.

5. For larger wealth players: Accelerate your digital adoption process by increasingly focusing on CX digital enhancement, tech-powered digital products/services, and data-driven managerial approaches.

6. For smaller wealth actors: Further increase your exposure to digital-physical ambidexterity by leveraging partnerships with digital providers who can help overcome size-related limitations in digital and innovation capabilities.

Conclusions

The e.foresight study highlights the significant untapped potential for digital development in Switzerland and Liechtenstein. Wealth leaders should view this as a pivotal opportunity for expanding their business. While the journey toward digital transformation and innovation may differ for medium/large players and smaller institutions, there are tailored strategic approaches for each category to leverage new technologies in the future. Those who act swiftly will be able to reinforce their positioning in a market that is becoming more competitive day by day with the rise of “digital-first” actors.

Source of the chart: e.foresight digital private banking benchmarking 2023

[print-me target=”div” title=”Print”]